Qualifying to own an SBA Financing the real deal Estate

You should use these SBA finance to find or book actual estate, generate street or surroundings advancements, create, reent or directory, or use the money given that working-capital for your date-to-date operations.

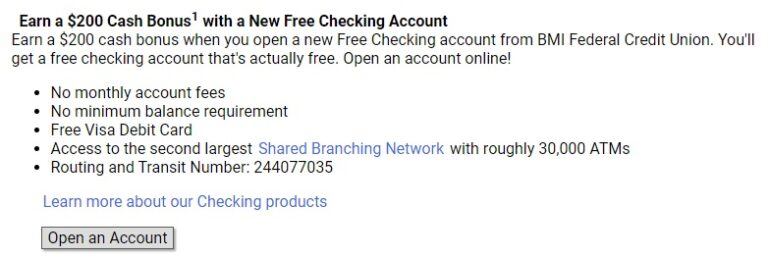

SBA money are popular since they’re noted for offering aggressive interest rates than the other lenders

These types of finance are notable for with positive prices and you may reasonable terms getting advertisers, which is why he’s thus fashionable. Even though you can buy a home with this particular SBA financing alternative, you cannot purchase home-based home that may after that feel turned local rental services.

As you never use SBA funds to purchase belongings, even if you want to change all of them on the financial support features just like the section of your organization, you’re able to use such loans some other parts of your own procedures.

Instance, you might make an application for a keen SBA financing to receive an increase at the office money to cover the repairs and you will home improvements out of an enthusiastic investment property your recently gotten. You can decide to buy the property within the cash following fool around with SBA mortgage financial support to help make the house preferred by alive from inside the.

This is a good business design if you’re interested for the to acquire foreclosed homes otherwise disappointed house that are usually even more reasonable than simply similar services in the region.

You could potentially secure small company money to cover a number of means for pop over to these guys individuals who meet with the proper standards. Listed below are some things you need so you can be eligible for a keen SBA financing:

- Your business have to be found in the Us otherwise its territories.

- You really need to have a business credit rating in the 600s (at a minimum) for many financing.

- You would like a flush criminal record and should not owe money in order to the federal government.

- In some instances, you will need to add equity into the mortgage.

- You must work a concerning-finances business.

Concurrently, you shouldn’t be capable of geting resource from other loan providers. You might need to begin with their financial support processes by making use of to possess most other business financing to show that you don’t safe all of them and want assistance from the brand new SBA.

SBA Loan Interest rates

One of the main reasons why you should envision making an application for an enthusiastic SBA loan ‘s the aggressive interest rates that come with they. Even although you can not use these fund buying residential genuine house, you are able to utilize the financing to other issue of your own providers.

The new SBA eight(a) money, rates begin during the 11.5% and you can visited 16.5%, having pricing with respect to the measurements of the loan and you may whether or not youre making an application for repaired-rates or adjustable-price conditions. The greater the loan, the reduced your own interest rate commonly normally end up being.

Such as for instance, a predetermined-price loan that’s lower than $twenty five,000 gets mortgage away from sixteen.5%. A predetermined-speed mortgage which is higher than $250,000 can get cost doing 13.5%. Such cost are derived from 2024 data and will fluctuate out of one year to a higher.

Given that SBA financing are used by the business owners which dont secure money various other means, these types of cost are beneficial as compared to their other choices. While small company loans is as reasonable just like the 7.71% within the 2024, particular lenders commonly charge up so you can 75% Annual percentage rate to assist entrepreneurs safe financial support.

Poor credit business loans, which are made use of should your individual credit score of the manager and/or team credit score is actually low, may have an apr more than 99%. Such loans are difficult to repay since the majority organizations spend almost all their currency repaying desire and aren’t able to pay the main effortlessly. Which produces a period of loans that is hard to break.